Vacation Rental Home Tax Rules 2019

If you are a vacation rental homeowner and have rented out your property during any time of the year, you will have to declare your rental income and you may enjoy certain tax benefits too. In this article, we are listing down the latest vacation rental home tax rules for 2019 that will help you in understanding the taxation rules and regulations that apply to your rental home property. Below is a guide that you can use to determine how to file the taxes related to your vacation rental.

Identify Your Vacation Rental Category

Image Source: Homepage

Based on the number of days for which you have rented out your vacation rental property, there can be 2 scenarios:

1. Home Used Mostly by the Owner

If you have rented out your property for less than 14 days in a year, then the tax rules are really simple. You don’t need to declare any rental income against this property but you cannot also deduct the expenses associated with the rental. However, you can still claim the usual deductions applicable for the homeowners such as mortgage interest, real estate taxes, and casualty losses.

2. Home Used by Owner and Tenant

If you rent out your vacation-rental property for more than 14 days, you will have to report your rental income on Schedule E (Form 1040). You can also deduct the expenses associated with a vacation rental, but you will have to pro-rate these expenses based on your personal-use time and the rental-use time.

Personal Use Time

According to the rules listed on irs.gov.in, the amount of time you personally use a home includes use by:

You or any other person who has an ownership interest in the home. This is not true if the home is rented to another owner as his or her main home and the other owner pays a fair rental price under a shared equity financing agreement.

A family member of any person who has an ownership interest in the home unless the family member uses the home as his or her main home and pays the fair rental price. Family members include Brothers and sisters; Half-brothers and half-sisters; Spouses; Lineal ancestors like parents or grandparents; Lineal descendants like children or grandchildren.

Any person who pays less than the fair rental value to use the home. This doesn’t apply to an employee who uses the home as lodging at the owner/employer’s convenience.

Any person who uses the home under a home-exchange arrangement with the owner; irrespective of whether the use is rent-free or paid. Note that any time spent at the home repairing and maintaining is not counted towards personal-use time.

Rental Use Time

Rental use time is any time when you have rented your vacation rental property at a fair rental value. As also mentioned earlier, if you rent out your vacation rental for more than 14 days, you would have to pro-rate your expenses based on the ratio of your personal time use and rental time use. You can simply use the number of days when you actually received the rent payments to figure out this ratio.

Identify Your Home Category

There is a limit on the number of expenses that you are allowed to deduct from your rental income based on whether your home is considered a residence or not. Therefore, it is important to identify your home category to figure out which rules would apply to you.

To know whether your home would be considered a residence or not, you need to take the following two tests. A home would be considered a residence if it passes the following:

To know whether your home would be considered a residence or not, you need to take the following two tests. A home would be considered a residence if it passes the following:

It should be used for personal purposes for more than the greater of (a) 14 days, or (b) 10% of the total number of days for which the home was rented at fair market value.

It should provide basic living accommodations such as a sleeping space, bathroom facilities and cooking facilities. A residence could be a house, an apartment, a condo, a mobile/motor home or even a houseboat.

Top 10 Vacation Rental Statistics

Declare Your Rental Income

Once you have identified your home category and vacation rental category, you would have to look at your rental income.

If you have rented out your property for less than or equal to 14 days, then you don’t really need to declare your rental income. However, if you have rented the property for more than 14 days, you would have to declare your rental income on Schedule E (From 1040).

If you have rented out your property for less than or equal to 14 days, then you don’t really need to declare your rental income. However, if you have rented the property for more than 14 days, you would have to declare your rental income on Schedule E (From 1040).

There can be the following types of rental income:

- Normal rent payments

- Advance rent payments

- Payments for cancelling a lease

- Expenses paid by the tenant

According to the rules listed on irs.gov.in, the rental income does not generally include the security deposit if the taxpayer plans to return it to the tenant at the end of the lease. But if the taxpayer keeps a part of the deposit, because of certain terms of the lease not met by the tenant, then this amount would have to be included in the rental income of the taxpayer.

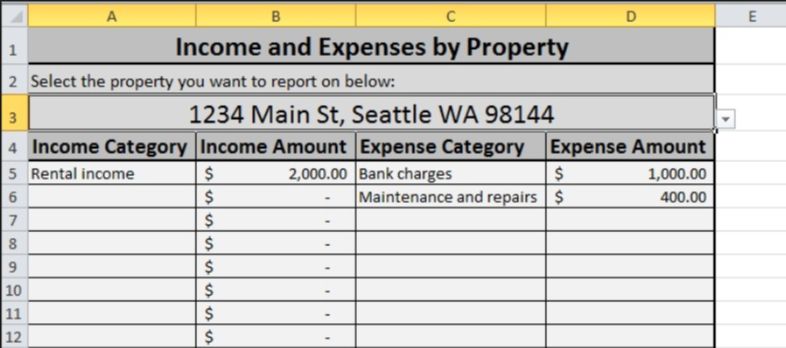

Declare Your Rental Expenses

You are allowed to deduct the expenses associated with your rental from your rental income (to get the taxable rental income) based on your vacation rental category and home category. If you rent out your property for less than or equal to 14 days, you can’t deduct the expenses associated with your rental. However, you can still claim the usual deductions applicable for homeowners such as mortgage interest, real estate taxes and casualty losses.

If you rent your vacation rental for more than 14 days, then you can deduct the expenses associated with your rental from the rental income but you would have to pro-rate the expenses based on the personal use time and rental use time. To figure the proration rate, divide the number of days you rented your property at fair market value by the total number of days the property was used for personal and business use. This method is applicable to all kinds of rental expenses.

If you rent your vacation rental for more than 14 days, then you can deduct the expenses associated with your rental from the rental income but you would have to pro-rate the expenses based on the personal use time and rental use time. To figure the proration rate, divide the number of days you rented your property at fair market value by the total number of days the property was used for personal and business use. This method is applicable to all kinds of rental expenses.

Moreover, based on whether your home is considered a residence or not, there is a limit on the amount of expense you can deduct. If your home is considered a residence, the deductible expenses can’t be more than the rental income. However, if your home is not considered a residence, the expenses that you deduct can be more than the rental income (you will be incurring losses in such cases, but your loss would be limited by the passive activity rules).

You will have to start deducting the expenses in the following order:

1. The Rental Portion of:

- Qualified home mortgage interest

- Real-estate taxes

- Casualty losses

- These expenses are deductible under the usual rules. You can only subtract the rental portion from rental income. The personal portion is deductible separately, subject to usual rules.

2. Direct rental expenses related to the rental property. These include:

- Advertising

- Commissions

- Legal fees

- Office supplies

3. Expenses related to operating and maintaining the rental property. These can be deducted up to the amount of rental income minus the deductions for items in points 1 and 2. This includes the interest that doesn’t qualify as home mortgage interest.

4. Depreciation and other basis adjustments to the home. These are deductible up to the amount of rental income minus the deductions for items in 1, 2, and 3 above. This includes things like improvements, repairs and furniture.

To learn how to figure your deductions, check the instructions in Publication 527: Residential Rental Property at www.irs.gov , Good thing to note here is that you can still carry over the expenses which you couldn’t deduct due to the rental income limit. You can use the carryover in one of these time periods:

- first year you have sufficient income from the property.

- When you sell the property.

If your home is not considered a residence, then the deductions for expenses are not limited by the rental income. If you are incurring a loss, you can use that to offset other income (subject to the usual passive-activity loss limitations listed on www.irs.gov.in)

Top 5 Complaints From Peoples When on Vacation Rental Houses

The New Tax Law (TCJA)

In 2018, a new tax law called Tax Cuts and Jobs Act (TCJA) went into effect. Some of the new changes that have been introduced through this law are listed below:

In 2018, a new tax law called Tax Cuts and Jobs Act (TCJA) went into effect. Some of the new changes that have been introduced through this law are listed below:

Lower Income Tax Rates

Almost all vacation rental owners pay income tax on their rental profits at the individual tax rates. TCJA has reduced individual tax rates for almost all brackets of taxpayers. This will lead to lower income tax on the rental profits from 2018-2025 for most vacation rental owners.

No Deductions for Vacation Rentals for Hobby

According to the earlier law, the expenses incurred on a hobby could be deducted on IRS Schedule A as a personal itemized deduction, limited to 2% of the taxpayers’ gross income. These deductible hobby expenses could not exceed the income generated from the hobby.

However, the new rules under TCJA completely remove the personal deduction for hobby expenses. While the income from the renal activity classified as a hobby would still be reported, the expenses incurred towards it cannot be deducted (therefore, leading to the payment of tax on the whole rental income generated from it).

New Limits on Property Tax and Mortgage Interest Deductions

The earlier law permitted personal mortgage interest to be deducted on up to $1 Million of acquisition indebtedness. Under the TCJA, new rules limit this deduction to interest on $750,000 of acquisition indebtedness now. The itemized personal deduction for real property taxes is also limited to a maximum of $10,000 now, earlier there was no limit imposed on this deduction.

However, the important point to note here is that these limits are not applicable for the vacation rental businesses, and therefore, the portion of a vacation rental owner’s mortgage interest and property tax allocated to the short-term vacation rental activity won’t come within these limits.

Personal Property Purchased for Rental Activity

Under TCJA, during 2018 through 2022, vacation rental owners can use 100% bonus depreciation to write off in a single year the full cost of long-term personal property they plan to use for their vacation rental business.

This property could, for example, include any furniture or appliances that the hosts purchase for rental activity. This bonus depreciation is applicable for both new and used personal property. Hosts can also use Section 179 in the tax code to deduct in one year up to $1 Million of personal property purchased for rental activity. However, this section can be used only for the property that is used over 50% of the time for the rental activity.

A new pass-through tax deduction

If your short-term rental activity classifies as a business by IRS for tax purposes, then you are eligible for deductions up to 20% of your net vacation income from your income taxes. This deduction is in addition to your other rental-related deductions.

To be qualified as a business by the IRS, the vacation rental owners should engage in their rental business regularly, continuously and systematically to make a profit. Therefore, the hosts who make no serious efforts to rent their property or rent it to their friends or relatives at a price below the market value won’t be eligible for this pass-through deduction. This deduction is also limited to 2.5% of the cost of the rental property plus 25% of the amounts paid to the employees.

Conclusion

Vacation rental home owners can enjoy a lot of property tax benefits by deducting the expenses related to the rental property from their declared rental income. Depending on how you hold the property and how you use it for personal vs. business use, you may be able to deduct the expenses directly incurred towards running the property as well as the indirect expenses incurred towards the management of your rental property. However, the tax laws for vacation rentals are quite complex, and therefore, it is advisable to use a tax professional to avail maximum tax benefits